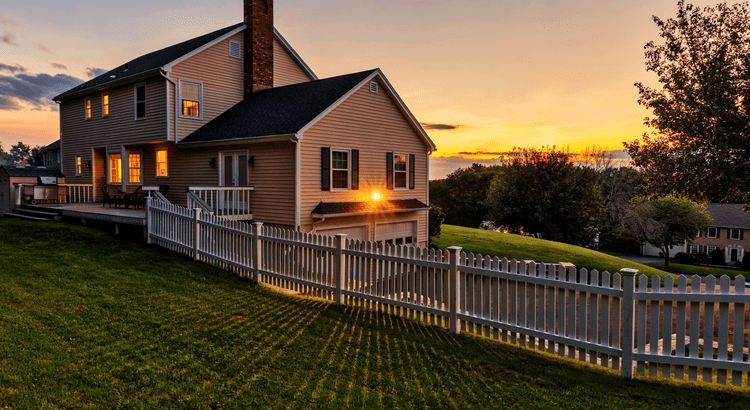

by Hydrus Connect | Jun 26, 2025 | Uncategorized

Here’s something you need to know. The housing market is getting back to a healthier, more normal place. And even though it may not sound like it, this shift is actually a good thing. It’s what you should expect. It’s just that our expectations have been skewed by the...

by Hydrus Connect | Jun 25, 2025 | Uncategorized

Fear of a recession is back in the headlines. And if you’re thinking about buying or selling sometime soon, that may leave you wondering if you should reconsider the timing of your move. A recent survey by John Burns Research and Consulting (JBREC) and Keeping Current...

by Hydrus Connect | Jun 24, 2025 | Uncategorized

Some Highlights A growing number of homeowners are overestimating today’s market. And that’s why the number of sellers dropping their price is back at normal levels. A lot of the time this is happening because they’re not paying attention to current conditions. The...

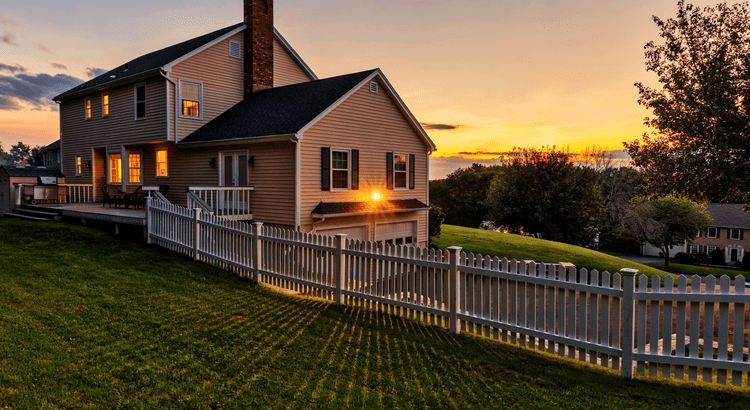

by Hydrus Connect | Jun 23, 2025 | Uncategorized

Life can feel a bit unpredictable these days. What’s happening with inflation? The economy? The housing market? But in the middle of all that uncertainty, there’s one thing a lot of people still crave – a place to call their own. Because when everything else feels up...

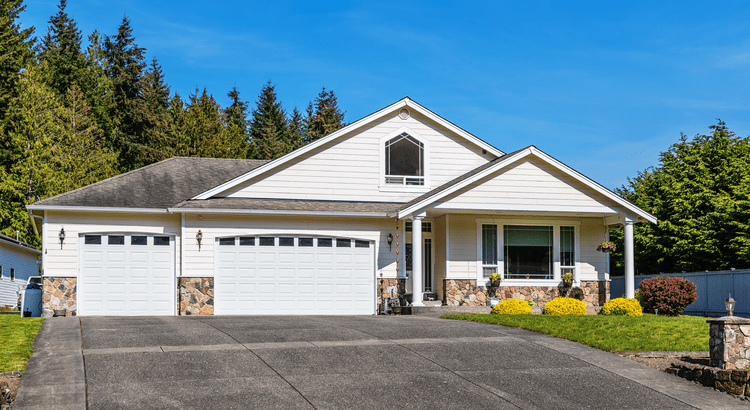

by Hydrus Connect | Jun 19, 2025 | Uncategorized

Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do next. But here’s something only the savviest buyers realize: This summer might actually be the best time to buy in...

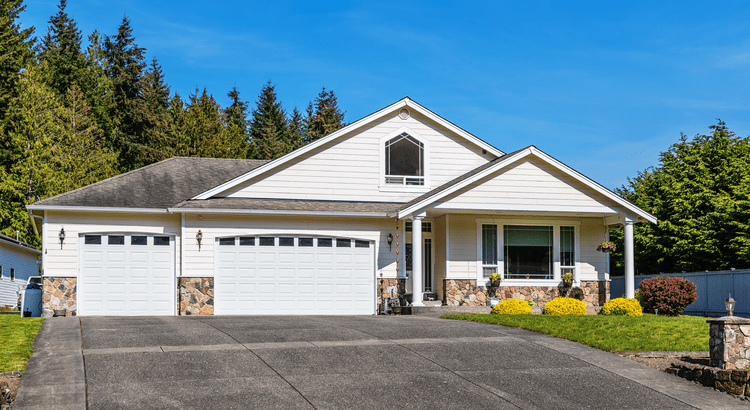

by Hydrus Connect | Jun 18, 2025 | Uncategorized

It’s hard to let go of a 3% mortgage rate. There’s no question about it. It’s the main reason why so many homeowners have delayed their move in recent years. But here’s something to consider. While your low rate might be ideal, it doesn’t make up being too cramped,...